Private debt: Many happy returns

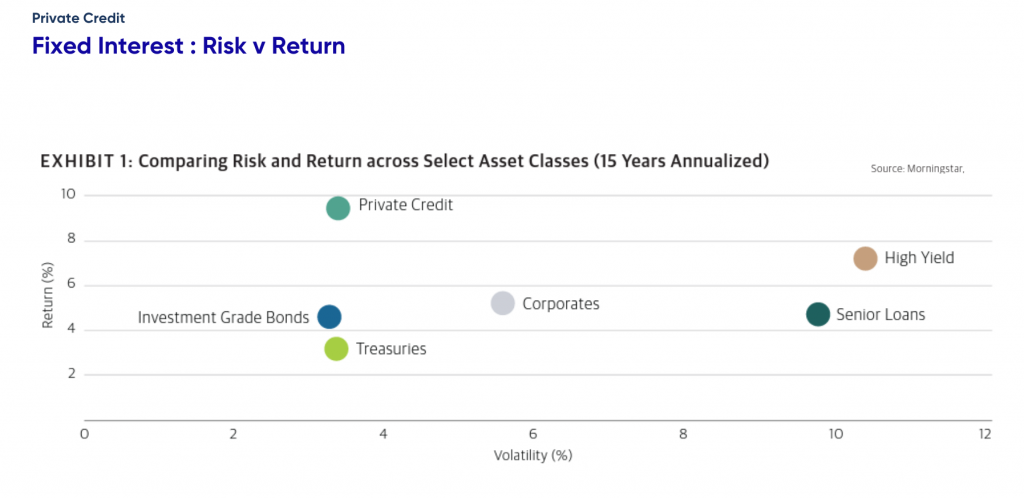

This article was originally published in InvestorDaily. 2022 was unusually bad for both bonds and equities as official interest rates and inflation surged, while interest from our clients in private credit and debt funds has continued to skyrocket. While equities posted one of their worst year since the 2007–2008 global financial crisis