This article originally appeared in the SIAA Monthly .

Will public market assets still form a core part of our clients’ portfolios in ten years time? Absolutely. Will private market assets form a significantly bigger part of client’s portfolios then compared to now? Undoubtedly!

A fair question to then ask about the increase in the relative size of private markets is whether it is only a trend that will fade or whether it is a systemic long-term shift? Just as importantly, we need to know the implications for how we structure our wealth advisory businesses.

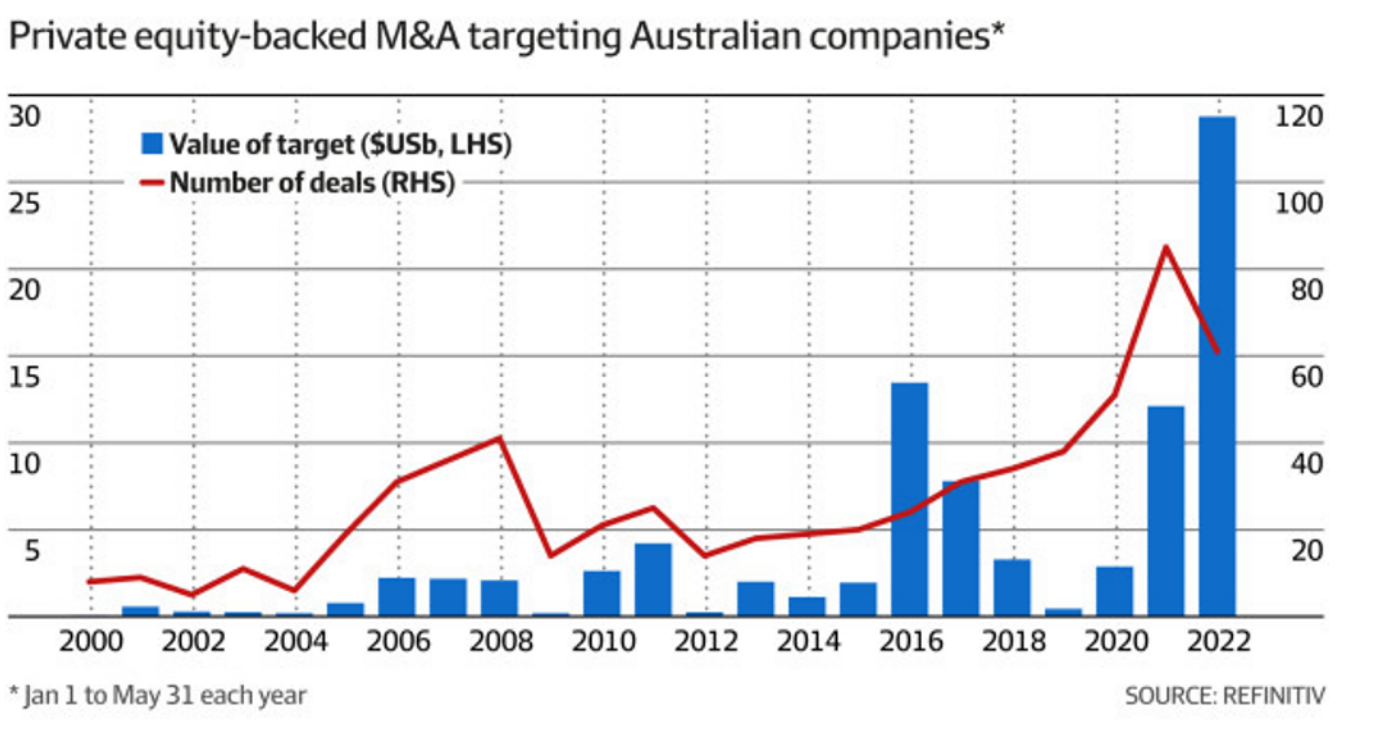

We have a maturing Venture Capital (VC) ecosystem in Australia that saw $10 billion deployed by VC companies in 2021 – and that is just capital deployed to start ups. That was almost as much as the $13 billion capital raised through ASX IPOs that same year. When you then also consider that the value of the private equity/ private capital involvement in public mergers and acquisitions hit +$40 billion in 2022 to date (over 90% of the M&A deals were private deals) you begin to see the size of the shift. Figure 1 shows that PE-backed deals are accelerating.

Figure 1. Private equity-backed M&A targeting Australian companies. Source: AFR & Refinitiv.

Figure 1. Private equity-backed M&A targeting Australian companies. Source: AFR & Refinitiv.

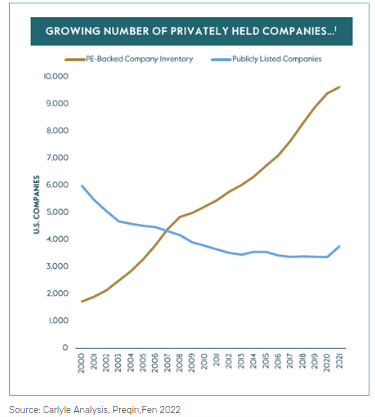

One of the key reasons that companies choose to list is to access growth capital. The reality of today is that many successful companies are accessing growth capital from VC and PE investors (think Canva and SafetyCulture in Australia) and international billion-dollar tech companies like Discord and TikTok parent company ByteDance.

As large institutional investors seek to deploy ever increasing amounts of capital the necessity of taking larger stakes in assets or businesses without the short-term volatility or scrutiny of public markets (or at least a reduced correlation to public markets) will continue to move institutional asset allocation toward private markets.

Additionally, whereas exits for VC firms used to be via an IPO, the rapid increase in VC funds (and later stage private growth capital) and the necessity for these funds to continue to deploy capital raised (dry powder) into the future means that capital is readily available to fund a company’s future raisings. Exits for buyouts are more frequently dominated by strategic sales to other companies and there has been rapid growth in sales from PE to other PE firms.

So while there will no doubt continue to be quality investment opportunities available on public markets, the drop in listings globally means that public companies today are much larger and older on average than in the past . Access to the higher growth opportunities in a portfolio will necessarily rely more on private capital opportunities in years to come.

So while there will no doubt continue to be quality investment opportunities available on public markets, the drop in listings globally means that public companies today are much larger and older on average than in the past . Access to the higher growth opportunities in a portfolio will necessarily rely more on private capital opportunities in years to come.

While these trends drive the growing conversation around the more glamorous rapid growth of private capital markets, less discussed is the shift of key segments of the debt and credit markets from public to private.

More private capital means more private debt…

This systemic trend towards more economic activity occurring in private companies at the expense of public capital markets has also led to a rapid expansion of the direct lending opportunity set. Australian private debt is estimated to be 10% of the corporate loan market, but heading towards the 40-50% share of non-bank lending now seen in Europe. In the US, the banks’ share of lending to small and medium business has shrunk to around 20%.

In Australia, there are underlying regulatory and macro-economic drivers of the growth of private debt. As in the US and Europe, strengthened lending guidelines and requirements for additional capital to be held in the wake of the global financial crisis of 2007-2008 led banks to reduce their exposures to mid-tier borrowers. In turn, this provided opportunities for non-bank financial institutions to expand their footprints in the private debt market.

From a regulatory perspective, APRA is likely to want private debt’s asset allocation classification to fall into “fixed income” for the purposes of the Your Future, Your Super performance test. As private debt is less affected by short-term market volatility and generally provides a higher yield with lower correlation to traditional fixed income asset classes it is likely to enjoy an increasing allocation in institutional super portfolios.

More tactically, the floating rate structure of Australian private debt protects against inflation and will likely be an attractive investment thematic in the current inflationary environment. Private debt in the form of corporate loans offers protection against inflation because they earn their returns from interest that is generally charged at a floating rate.

The takeaway:

The shift from public to private markets is structural and can’t be ignored. From the perspective of a wealth adviser, the ability to cater for these types of assets and the structures that they are paired with is critical. The increasing usage of private market assets will cause more advisers to question whether they are running an administration business, or an advice business, as the old tool sets of wrap accounts and spreadsheets struggle with investments that include capital calls, syndicates and other esoteric structures.